ESG issues in the supply chain

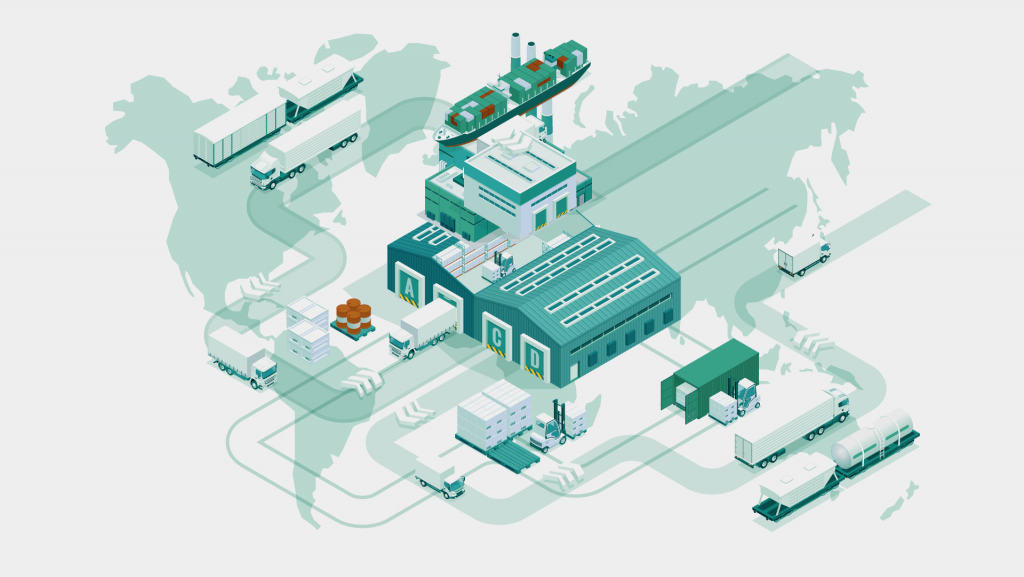

Insurers contract a wide network of providers to handle claims. The services of these partners enable policyholders, in most cases, to make their insurance tangible. For example, a traffic accident may require a lawyer, a tow truck, an ambulance (depending on the accident severity), and a workshop to repair the vehicle. These service providers are not only contracted for automobile accidents, but they are also important for other insurance such as health, fire and earthquake, aviation, transportation, among others. In short, suppliers are an essential and inseparable part for handling claims covered by insurance.

In a more illustrative way, insurers hire direct and indirect labor force, so they may positively impact many people’s life by improving their livelihoods. The insurance sector is also responsible for fostering the resilience of these actors in the supply chain, in order to ensure the sustainability of its activities. In this role, the insurance companies promote sustainable development by strengthening human rights, implementing eco-efficiency actions, and promoting transparency (Jiménez, 2020).

What are we doing?

Fasecolda supports the insurance industry suppliers to include ESG factors in their corporate policies. We provide them with advice and training, in order to, in the medium and long term, they can change their corporate policies and implement sustainable practices that benefit them, their employees, the environment where they operate, and the customers to whom they provide their services.