What are they?

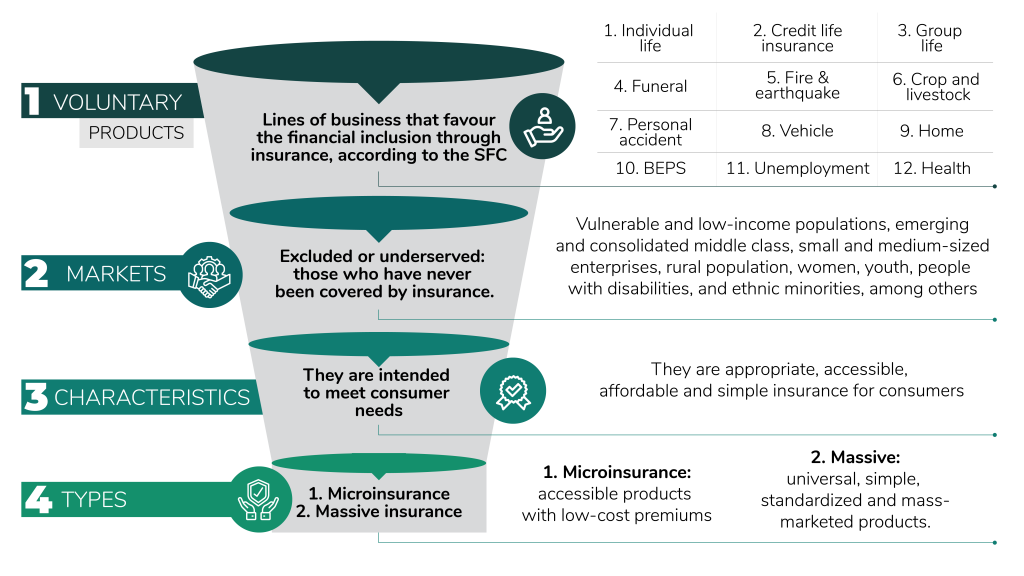

Inclusive insurance denotes the products that favor financial inclusion in insurance*, they are bought voluntarily by the policyholder and are intended for the excluded or underserved market, i.e., those who have never been covered by insurance; compulsory insurance is not considered inclusive insurance.

Additional links

This webinar presented lessons learned by three insurance associations in the region: the Mexican Association of Insurance Institutions (AMIS), the Colombian Insurers Association (Fasecolda), and the Salvadoran Association of Insurance Companies (ASES). They explored the keys to success in achieving efficient and effective coordination with the industry, the government, and the regulator, and in raising awareness of underserved segments about the importance of insurance. It was also discussed the topic of strengthening the companies’ capabilities in the development of products focused on customer needs.

*THE FINANCIAL SUPERINTENDENCE OF COLOMBIA, IN ITS 2019 FINANCIAL INCLUSION REPORT, DEFINED THE FOLLOWING LINES OF BUSINESS AS THOSE THAT FAVOR FINANCIAL INCLUSION IN INSURANCE, SINCE THEIR RISKS ARE MORE COMMON AND CAN BE MORE EASILY ACCESSED BY THE POPULATION: “INDIVIDUAL LIFE, DEBTOR GROUP LIFE, CREDIT LIFE INSURANCE, FUNERAL, PERSONAL ACCIDENTS, FIRE AND EARTHQUAKE, CROP AND LIVESTOCK, EXTRA-CONTRACTUAL LIABILITY, VEHICLE (MOTORCYCLE AND CAR), UNEMPLOYMENT, PERIODIC ECONOMIC BENEFITS (BEPS), HEALTH, THEFT, AND HOME”. (RIF, 2019. P. 138)