Climate change is a macro risk

In the insurance sector, we consider climate change as a macro risk that impacts us on multiple fronts, as it affects the performance of our policyholders, the sustainability of our suppliers, and the stability of the companies we invest in. We are concerned about the exacerbation of risks currently covered by our insurance products and we are seeing the emergence of new risks for which protection products must be created. Regarding institutional investment, we are working harder every day to prepare our portfolios to face the complex effects of climate change. In addition, we are constantly working to strengthen the capabilities of our supply chains and supplier networks, so that they are trained and ready to help us deal with the different disasters that may occur in the country.

Insurance relates to climate risk management

We are sure that the best way to prepare the country to face climate change is through effective risk management, promoting the assessment of the impact and its management in advance. In this sense, insurance is a financial tool that has proven to be effective in providing support when facing adverse conditions. In turn, when policyholders buy a policy, they are encouraged to create awareness of the risk and to take actions to manage it, preventing its materialization and, therefore, the last action to be taken is risk transfer. In addition to the above, insurance is available for all sectors in the economy, protecting people and assets.

To manage climate change, information, predictive analysis ability, technology, interinstitutional efforts, and inclusion in insurance are required.

The right management of climate risk requires the implementation of forward-looking models that allow having enough information to anticipate the materialization of events that could affect the country. This is essential for massifying protection products that allow us to reach the vulnerable population, for example, through the creation of parametric insurance, or index-based insurance. This is a challenge that implies the joint work of the different actors in the system, it is required the efficient management of information, which has been collected in multiple sources, and the intensive use of technology to improve its processing, so that it can be used in the best way.

In addition, it is necessary to promote financial inclusion in those populations that are more vulnerable to climate change. In this regard, we are hopeful about the new technological advances that will undoubtedly broaden the scope of insurance protection, and we trust that advances in climate change issues can be focused on the country’s urgent needs.

Our responsibility in the insurance sector

Insurance companies are risk managers, through products that cover potential losses to society, and long-term investors that finance the real economy. These circumstances, intrinsic to their activities, highlight the great responsibility in the management of climate risk, which includes different kinds of challenges; we trust we can face them in the best possible way, with the support of government agencies.

It is required to join and focus efforts on prioritized objectives

In Fasecolda we see how climate change issues are becoming more relevant every day, especially due to the new adaptation approach that is being promoted by different entities. There has been an increase in initiatives aimed at promoting the country’s resilience, they are diverse and, in some cases, focused on addressing the same problem, although they are promoted by different actors. This is resulting in redundant efforts that generate fatigue in the actors of the system, who must focus their efforts multiple times on the same issue.

Challenges for climate risk management

The following is required to manage climate change:

- Information

- Abilities for looking-forward analysis

- Technology and technological abilities

- Interinstitutional joint efforts and inclusion in insurance.

It should be noted that the right management of climate risk requires the implementation of forward-looking models that allow having enough information to anticipate the materialization of events that could affect the country. This is essential for massifying protection products that allow us to reach the vulnerable population, for example, through the creation of parametric insurance, or index-based insurance. This is a challenge that implies the joint work of the different actors in the system, it is required the efficient management of information, which has been collected in multiple sources.

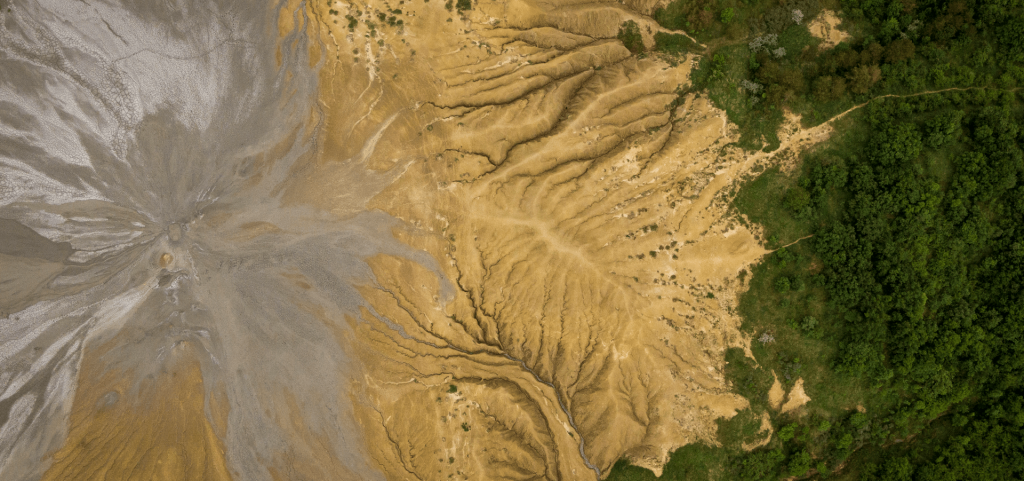

Climate change costs

The effects of climate change represent high costs worldwide due to natural disasters such as floods, landslides, droughts affecting crops, forest fires, and others. According to the World Bank, natural disasters cost about 18 billion USD per year for low and middle-income countries, transportation and energy generation infrastructure are the most affected (WB, 2020). For the year 2019, natural disasters and claims accounted for 146 billion USD and in the last ten years, the average costs have been USD 212 billion. For Latin America and the Caribbean, these costs were USD 12 billion, USD 5.2 million of them were insured (SwissRe, 2020).

Insurers face many challenges in assessing and modeling climate risks, as historical records of environmental events, as well as climate and socioeconomic trends, must be assessed to project potential risks that may raise by climate change.