Insurance in Colombia

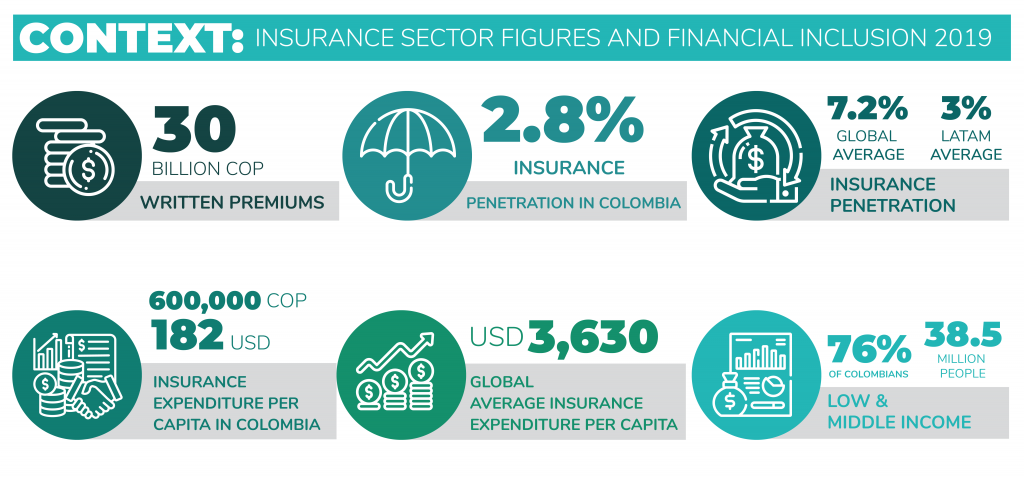

Results in the last report on financial inclusion in the country show a lag in insurance. At year-end 2019, total written premiums reached COP 30 trillion, and the penetration rate in Colombia (premiums/GDP) was 2.82%, while in Latin America it was 3% and the world average was 7.2%.

Regarding per capita insurance spending, it was USD 182 in Colombia, USD 244 in Latin America and the Caribbean, and USD 818 globally. The OECD countries, of which Colombia is already a member, have an average expenditure per inhabitant over USD 3,600. The challenge of financial inclusion in insurance for Colombia is based on the potential of 38.5 million citizens with low or medium income, 76% of the country’s population.

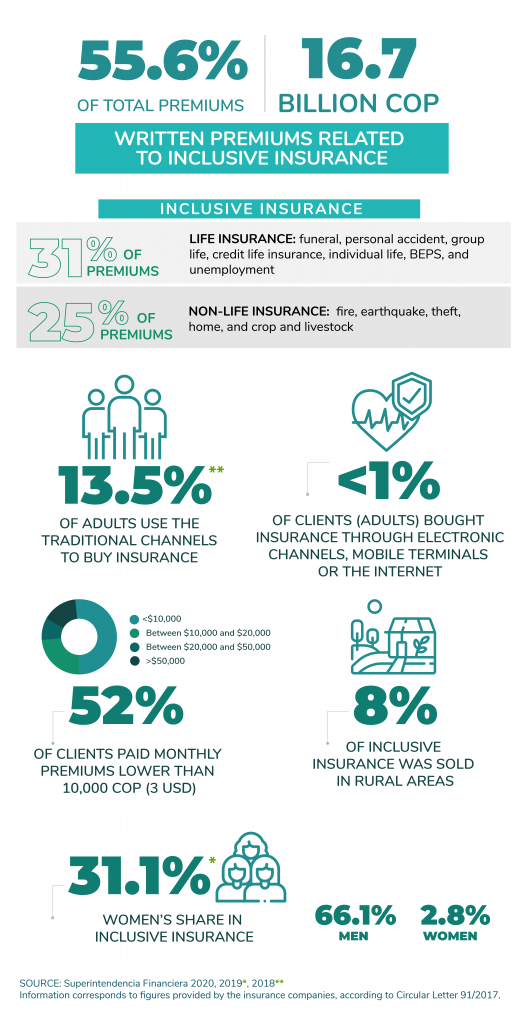

Inclusive insurance penetration

As mentioned above, written premiums were COP 30 trillion in 2019, of which COP 16.7 trillion (55.6%) correspond to inclusive insurance lines of business (31% were personal insurance and 25% were property and casualty insurance).

13.5% of adults use formal financial insurance services and 52.2% of the insured people, in the lines of business considered inclusive, pay monthly premiums lower than COP 10,000. The traditional channels (insurance companies and intermediaries) are the most used to buy insurance, although the alternative ones (networks and correspondents) have increased in the last reports.

Statistics show that men buy more insurance than women and that access to insurance in rural areas of the country is lower than in urban areas.